Where's Your Money Going?

Tax Advantages for Hard Liquor

The U.S. government has recognized the differences between beer and liquor since Prohibition’s repeal in 1933. Hard liquor affects drinkers very differently than beer, which is why the federal government has always and continues to support a tax framework that distinguishes between the two.

The liquor lobby is attempting to undermine this system to line the pockets of multi-billion-dollar liquor conglomerates. Any adult consumer knows a vodka martini is not the same as a beer, but the liquor industry is trying to blur the lines surrounding canned cocktails as they have pushed them more aggressively to consumers in recent years.

Instead of playing by the rules, the liquor lobby is seeking to manipulate the tax code to give canned cocktails an advantage over beer. Massive liquor corporations want their canned cocktails to be taxed like beer, even though these products often have more alcohol.

Unfortunately for consumers, some states have already seen what happens when these liquor giants get their way. Legislators in Michigan and Nebraska decided to give out tax breaks for canned cocktails with the expectation that such legislation would lower consumer prices for those beverages. What was the result, according to a study from Public Sector Consultants?

“Analysis shows dramatic price hikes for [canned cocktails] in both states: a 44 percent jump in Michigan and a 65 percent jump in Nebraska since the legislation passed.”

Another study from the Maryland Alcohol and Tobacco Commission uncovered even more about the liquor industry’s deception. The agency’s study found massive tax revenue losses for states that cut taxes for canned cocktails, explicitly stating…

“…the reduction of the tax rate for ‘low proof spirits’ has not led to an increase of sales of these products to fully offset the revenue loss, nor…did the retail cost of these products change in any beneficial way for the consumer.”

Additionally, because they are made with hard liquor, canned cocktails have a longer shelf life than beer, which is a perishable product. If big liquor gets its way and lowers taxes on canned cocktails, the result would hurt more than just consumers. The livelihoods of millions of Americans from barley farmers to wholesale distributors to bartenders and more would be endangered by giving a tax break to the liquor industry.

What makes the liquor lobby’s demands for special tax status even more audacious is that Congress modernized—and lowered—federal alcohol taxes across the board just a few years ago. The Craft Beverage Modernization and Tax Reform Act (CBMTRA) became law in 2017 and temporarily reduced tax rates for all alcoholic beverage categories. As a result of overwhelming bipartisan support, these changes were made permanent in 2020 and remain in place today.

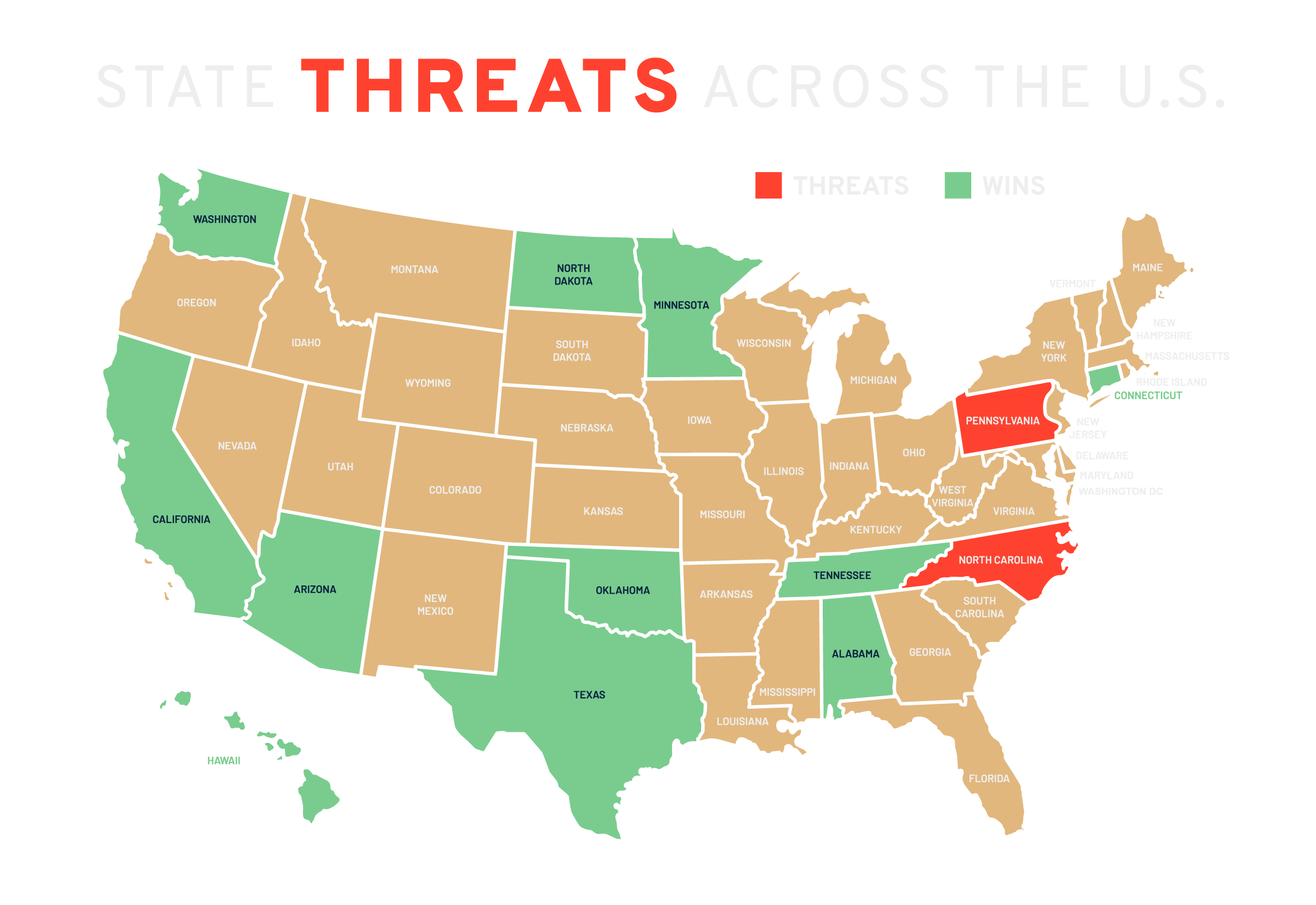

The good news? Many more state legislatures are recognizing when liquor corporations are trying to pull the wool over their eyes. The map below shows all the different states that have rejected these absurd tax cut proposals.

The Bottom Line?

Canned cocktails and beer are different products. Congress and state legislatures across the U.S. should treat them as such.

Want to read about the latest in the battle against unfair liquor subsidies?

Get All News Here